#CBSE Question Bank Class 11 Economics

Explore tagged Tumblr posts

Text

Best CBSE Question Bank for Class 11 2024 Economics with Topic-wise Questions

Together with CBSE Question Bank Class 11 Economics serves as Chapter-wise Study Material to prepare for 2024-25 exams. Best Question Bank for Class 11 CBSE 2024-25 as per latest syllabus includes Short/Long Answer Type Questions, MCQs, Case/Source-based Integrated Questions, Solved NCERT Textbook Exercises & Practice Papers to excel the concepts and ace the 2024-25 exams.

#Best CBSE Question Bank#Class 11 2024 Economics#CBSE Question Bank Class 11 Economics#Best Question Bank for Class 11 CBSE#Best CBSE Question Bank for Class 11 2024

0 notes

Text

Affordable and Trusted: Where to Find the Best Home Tuition Near Me!

Sure, there are YouTube videos and online courses everywhere—but can a screen track your child’s learning gaps? Not quite. That’s where home tuition shines. Having a real person to explain, revise, test, and motivate is still the gold standard in education.

Parents across India are realizing that while digital tools help, nothing beats a personal tutor who sits next to your child and ensures they understand every concept.

So, if you've been googling "Best Home Tuition Near Me", you’re already on the right path.

The Real Benefits of Local, Trusted Home Tuition

Personalized Attention

No two students learn the same way. Home tutors adapt their teaching methods to your child's pace, interests, and strengths. This boosts confidence and ensures better results.

Flexible Scheduling

Forget the rigid schedules of coaching centers. Home tuition allows parents and students to set timings that fit their school and activity calendars.

Exam-Focused Preparation

Home tutors provide extra question practice, mock tests, and revision sessions before exams, giving your child an edge in scoring higher.

What to Look for in the Best Home Tuition Near Me

Qualifications and Experience

The best home tutors are well-qualified, often with teaching degrees or strong academic backgrounds. Always ask for credentials and demo classes.

Teaching Style and Student Compatibility

A tutor should not only be knowledgeable but also friendly and communicative. Comfort between the tutor and student is key to effective learning.

Affordability without Compromise

You don’t need to spend a fortune. Great tutors offer value-driven learning packages that are both affordable and high-quality.

From Class 1 to 12 – Home Tuition for Every Stage

Primary Classes (1–5): Foundation Years

Focus areas:

Basic arithmetic and number sense

Reading, comprehension, handwriting

Spelling and phonics

Understanding science and environment

Middle School (6–8): Concept Clarity Stage

Focus areas:

Subject introductions: Algebra, Geometry, Geography, Civics

Grammar and vocabulary building

Regular tests to build academic stamina

High School (9–10): Board Preparation Zone

Focus areas:

CBSE/ICSE board pattern

NCERT solutions and question banks

Model test papers and time management

Senior Secondary (11–12): Career-Defining Time

Streams covered:

Science (PCM/PCB)

Commerce (Accounts, Eco, Business Studies)

Humanities (Pol. Science, Psychology, History, Sociology)

Top Subjects Covered by the Best Home Tutors Near You

Mathematics (All levels)

Science (Physics, Chemistry, Biology)

English & Hindi

Social Studies & EVS

Accountancy & Economics

Geography, History, Civics

Computer Science

Sanskrit & French (on request)

Spotlight on Saraswati Tutorials – Your Local Tuition Partner

If you're still wondering where to find the Best Home Tuition Near Me, then look no further than Saraswati Tutorials – a name trusted by hundreds of families in Dehradun.

Why Parents Trust Saraswati Tutorials

Tutors are screened, experienced, and well-reviewed

Tutors assigned according to student's subject, class, and comfort level

Free demo class and easy tutor replacement if needed

Transparent pricing and weekly student reports

How Their Tutors Adapt to Your Child’s Learning Style

Whether your child is a fast learner or needs patient repetition, Saraswati’s tutors adjust their pace and techniques. Their aim? To help your child love learning and ace exams.

Areas Covered for Best Home Tuition Near You

Saraswati Tutorials provides home tutors across Dehradun in:

Rajpur Road

Balliwala

Nehru Colony

Race Course

Clement Town

Prem Nagar

Dalanwala

Sahastradhara Road

Vasant Vihar

So yes, if you're searching for "Best Home Tuition Near Me", Saraswati is probably already in your neighborhood.

How Much Does Home Tuition Cost? A Quick Guide

Class LevelSubjectsPrice Range (Per Month)Class 1–5All Subjects₹1,500 – ₹3,000Class 6–81–2 Subjects₹2,000 – ₹4,000Class 9–10Core Subjects₹3,500 – ₹6,000Class 11–12Stream-Specific₹5,000 – ₹8,000

Note: Actual cost may vary depending on subject complexity and tutor qualifications.

FAQs – Best Home Tuition Near Me

1. Is home tuition better than coaching classes?

Yes. Home tuition offers personalized, distraction-free learning, which coaching centers can’t match.

2. Can I request weekend classes only?

Absolutely! Saraswati Tutorials offers flexible weekly schedules including weekend-only tuition.

3. Do home tutors bring study material?

Yes. Most tutors bring their own worksheets, question banks, and notes aligned with the student’s syllabus.

4. Are tutors available for competitive exam prep too?

Yes. Tutors for JEE, NEET, NDA, CUET, Olympiads are also available.

5. What if I don’t like the tutor after a few sessions?

No worries! Saraswati Tutorials allows easy tutor replacements within 1–2 days.

6. How do I get started?

Just book a free demo class through their contact number or website. A coordinator will guide you through the next steps.

Final Thoughts – Invest in the Right Tutor Near You

In today's fast-paced academic environment, you don’t need to look far or pay extra. The Best Home Tuition Near Me can be found right in your neighborhood—affordable, personalized, and fully aligned with your child’s academic needs.

With trusted names like Saraswati Tutorials, you’re not just hiring a tutor—you’re building your child’s future.

0 notes

Text

Top Government Schemes for Girl Child in India: Empowering the Future

India has taken significant steps to Empower Government Schemes for Girl Child by implementing a range of government schemes that provide financial support, educational assistance, and health benefits. These schemes aim to uplift girls from underserved backgrounds, ensuring they receive the opportunities and resources needed for a brighter future. Let’s explore the top government schemes for girl children in India and how they work to secure a promising path for them.

Comprehensive Guide to Government Schemes for Girl Child in India

Why Government Schemes for Girl Children are Important

Bridging the Gender Gap Gender inequality remains a significant challenge in India, and these schemes aim to close the gap by providing incentives for the education, health, and welfare of girls.

Reducing Financial Barriers These initiatives help parents overcome the financial constraints that often hinder a girl’s education and personal growth.

Top Government Schemes for Girl Child in India

Beti Bachao Beti Padhao (BBBP) The Beti Bachao Beti Padhao scheme focuses on preventing gender-biased abortions, promoting education, and improving the welfare of girl children in India.

Benefits: Increased awareness about the importance of girls’ education.

Eligibility: All Indian families with a girl child.

How to Apply: Visit your nearest Anganwadi center or government office.

Sukanya Samriddhi Yojana (SSY) This savings scheme for the girl child offers tax benefits and high-interest rates, helping parents accumulate funds for their daughter’s education and marriage.

Benefits: Tax savings under Section 80C, secure financial future.

Eligibility: Open for girls below 10 years.

How to Apply: Open an account at a post office or authorized bank.

Balika Samridhi Yojana Balika Samridhi Yojana provides financial assistance for the education and marriage of girls from economically disadvantaged families.

Benefits: Scholarships for education up to class 10 and a one-time grant on reaching adulthood.

Eligibility: Available for girls born in households below the poverty line.

How to Apply: Enroll through local government bodies or schools.

CBSE Udaan Scheme This scheme supports girl students in preparing for engineering entrance exams by offering free coaching and study resources.

Benefits: Quality coaching for competitive exams, free study materials, and financial aid.

Eligibility: Girl students studying in class 11 or 12 with a minimum GPA.

How to Apply: Register through the official CBSE Udaan website.

How to Apply for Government Schemes for Girl Child

Documents Required:

Proof of age and identity (birth certificate or Aadhaar)

Income certificate (if applicable)

Residence proof (ration card or Aadhaar)

Passport-sized photographs

Steps to Apply:

Visit the official portal or nearest government office.

Submit the required documents.

Complete the application form.

Track the application status online (if available).

Frequently Asked Questions (FAQs)

Q1: Who can apply for government schemes for girl children? A: Government schemes for girl children are generally available to all Indian citizens, though specific eligibility criteria such as age, family income, and educational background may apply.

Q2: Can I open a Sukanya Samriddhi Yojana account for my daughter at any age? A: No, the Sukanya Samriddhi Yojana account can only be opened for girls aged below 10.

Q3: Is there any financial assistance for girls' higher education in these schemes? A: Yes, schemes like CBSE Udaan provide support for girls preparing for higher education in technical fields.

Conclusion:

Government schemes for girl children in India are instrumental in promoting gender equality and providing a supportive environment for the holistic development of girls. From health and education benefits to financial aid, these initiatives are structured to empower girls to achieve their full potential. By availing of these schemes, families can ensure a secure and bright future for their daughters, paving the way for an empowered and prosperous society.

#goverment#goverment jobs#exams#results#online work#sarkariyojana#sarkarinaukri#sarkari jobs#sarkari exam

1 note

·

View note

Link

♦100% Updated with Latest Syllabus & Fully Solved Board Paper ♦Crisp Revision with Topic wise Revision Notes, Mind Maps & Mnemonics

0 notes

Text

Class 11 Economics NCERT

The Class 11 Economics ncert syllabus has a wide range of concepts that serve as the introduction to the subject. All the questions provided in the NCERT books cover all the major Economics topics you will need to get a good grasp on the fundamentals.

Economics is a social science that pertains to the production, distribution, allocation, and expenditure or utilisation of goods and services. Economics explores how individuals, trades, governments and countries make choices on distributing resources to attain the optimal output. Due to its complexity, Economic analysis requires a combination of several analytical processes. So, this social science subject is more like mathematical logic.

Class 11 Economics NCERT Textbook Solutions

By studying the fundamentals of Economics in Class 11, you can assess your calibre and interest in the field and pursue it later on in your career. This subject helps you develop skills that have great value and importance in everyday life. At the heart of it, the Economics syllabus is designed to help you learn about the production and consumption of products and services. It also deals with how they are distributed in the markets, their demand, and supply.

Economics helps you understand and analyse the business decisions made by organisations. This includes individual projects as well as government undertakings. As an individual, learning this subject will help you plan how to spend on work, basic necessities, our entertainment and leisure time, and at the same time how to maximise your savings. By getting a hang of the fundamentals of Economics, you would also understand how trends, inflation, and interests affect your financial decision-making ability.

Ultimately, Class 11 Economics is a critical subject that introduces you to several important concepts that are applicable in real-life scenarios. Some examples are demand, supply, market mechanism, and banking systems and other concepts that determine the mechanism of both micro-economic and macro-economic factors. Microeconomics is the study of prices for goods and services based on the allocation of resources and human choices. On the other hand, macroeconomics studies economics as a whole, in a large entity.

NCERT Solutions for Class 11 Economics

Our subject experts at Extramarks have compiled a comprehensive document outlining the solutions to all the exercises included in the NCERT Class 11 Economics book. The solutions are accompanied by examples, diagrams, and detailed analysis of important topics. It is designed in such a way that every student can have a fulfilling learning experience, and save time, as they will not have to research each topic separately.

NCERT Solutions for Class 11 Economics

Here are the chapter-wise solutions for 11th economics NCERT books.

NCERT Solutions for Class 11 Economics: Chapter 1 and Chapter 2

Chapter 1 and 2 provide an introduction to the Indian Economic system. They also highlight the changes it has undergone since independence, and the journey of India’s economy from a stagnant and underdeveloped one to its current state.

What’s more, the solutions also cover topics like:

India’s occupational structure

India’s demographic conditions

India’s per capita income through the years

The development of India’s infrastructure

Five-year plans

Reforms in the agricultural sector

NCERT 11th Economics Solutions: Chapter 3 and Chapter 4

Chapter 3 and- 4 of NCERT Solutions for Class 11 Economics covers significant topics like:

Globalisation

Privatisation

Liberalisation

Poverty

Reformative policies undertaken by the Indian Government and their pros and cons

The chapter will enable students to understand economic factors like direct tax, disinvestment, indirect tax and others. Additionally, they will also get to learn about the impacts and causes of the Sircilla tragedy.

Class 11th NCERT Economics Solutions: Chapter 5 and Chapter 6

NCERT solutions of the CBSE Class 11 Economics book for chapters 5 and 6 cover topics like human capital formation in India and rural development.

The solutions provided by Extramarks not only explain the general purpose of these two economic concepts, but also outline the impact that they have had on the Indian economy. To appreciate their impact, students can take a look at their consequences, like generating employment, increasing productivity. Finally, these chapters talk about the distinguishing factors between financial and physical capital.

Importance of NCERT Class 11 Economics

Our NCERT solutions class 11 economics are written in an easy-to-follow language

All the answers are written following the NCERT guidelines. So, you need not worry about wasting time on content that is out of the syllabus

Our solutions are curated and verified by subject matter experts. So, all the answers are accurate and will help you fetch a high score in the exam. There is no need to worry about the credibility of these answers, unlike guides that are outdated

We provide a detailed introduction to crucial topics. This will help strengthen concepts right from the beginning and will help you in your future endeavours as well

We’ve included diagrams with key topics to help you learn faster

You can practise with similar examples to clarify the concepts

Our NCERT solutions class 11 economics provide step-by-step solutions to numerical problems

The solutions are arranged in chapter-wise order. So, you can refer to them conveniently

Our solutions are free of cost, so you can download, print, and share them whenever you like

1 note

·

View note

Photo

Best Books for Engineering - Engineering Textbooks Engineering can be defined as the application of mathematics and physics in a straightforward and straightforward manner. A wide range of applications in mechanical and aerospace engineering, civil engineering, medical and biological engineering, financial engineering, economics, and a variety of other fields can all be included in this definition.

For More Details Visit Here:- https://www.amazon.in/stores/page/3E9B6C51-8D9B-448A-9FEB-D00CA65A99F8

Our Books:- CLAT Mock Test Sample Papers, Best Books for Engineering, CBSE Handbooks Class 11 12, CLAT 2022 Exam Book, Competitive Exam Books, GATE 2010 to 2021 Solved Question Papers, GATE 2022 Exam Book, GATE Previous Year Solved Question Papers, Karnataka PUC Board Class 12 books, Karnataka SSLC Board Class 10 books, Medical Entrance Exam Books, PUC Previous Years Solved Papers, Question Bank 2021-23, SSLC Previous Years Solved Papers, SSLC Question Bank 2021-22

For CBSE :- CBSE Workbook Class 1, CBSE Workbook Class 2, CBSE Workbook Class 3, CBSE Workbook Class 4, CBSE Workbook Class 5

For Olympiad :- Olympiad Books Class 1, Olympiad Books Class 2, Olympiad Books Class 3, Olympiad Books Class 4, Olympiad Books Class 5

#Best Books for Engineering#Best Books Engineering#Best Books of Engineering#Best Books for Engineering exam#Best Books for Engineering pdf

1 note

·

View note

Text

Accounts Coaching Classes in Chandigarh

Accounts Coaching Classes in Chandigarh offers Accounts Coaching for Class 12th for CBSE, ICSE, AND PSEB board students. Accounts Academy in Chandigarh has designed 11th 12th Class Tuition in such a way that it will clear all the basic fundamental concepts of CBSE 11th 12th class syllabus for those students who wish to excel & score good rank in CBSE 11th 12th Examination. Accounts Coaching Classes in Chandigarh is one of the best tutoring institutes for Class 11th & 12th Commerce students. Our teachers cover here apart from teaching and also work as their instructors.

Our unique study method combines modern practice techniques and our accounts programs are easy to design in coaching classes. Our training for those accounts helps the student overcome all confusions about accountancy. The study involves accounting laws, fraud detection, managerial accounting, and auditing in the study. Motivated accountants generally take their accounting courses through a full degree program. Traverse the contents of general accounting classes by studying accountancy.

Our

Accounts Training

Accounts Classroom Training

Accounts Mock Test

Accounts daily Practice

Accounts Problem Solving Classes

Accounts Weekly Practice Test

Accounts Result

Some common concepts we hear here involve auditing procedures and standards, cost analysis, financial statements, and reporting, tax deductions and liabilities, international accounting, business or tax research methods, global economy, etc. Solve all your confusion with the Accounts Coaching Institute in Chandigarh. In our accountancy coaching classes in Chandigarh, you get the full solution for the accounts. Students learn the business side of accounting in this classical classroom, such as direct handwriting, bookkeeping, numerous equations, and liabilities. Involves original accounting principles and how they relate to making statements. This accounting course is a must for any accounting major in our tuition classes. We also provide all the subjects for commerce stream 11th & 12th students like Accounts, Business Studies, Economics, English, and Mathematics

Vision

To attain apex in sharing knowledge, training students in accountancy and related domains, and to provide professional guidance for their success.

Mission

To provide students with quality-oriented personalized attention by delivering educational solutions and to see they prosper their career.

Focus

The teaching methodology is designed in such a way to realize how learning accountancy is made so easy, with an ultimate goal to attain the untold secret of success in every walk of life.

Syllabus for Class 11th Accountancy

Accountancy syllabuses differ from schools affiliated to one board of education to schools affiliated to another board. While there may be some differences across syllabuses advised by several education boards, the core study areas remain the same. Here are the things that commerce students have to cover in Class 11th.

Theoretical Framework – Benefits, Importance, Objectives, and Limitations of Accounting, Basic Accounting Terms

Theory Base of Accounting – presumption, Principles, Accounting Standards, Double Entry System

Recording of Transactions

Debit and Credit Rules

Journal

Cash Book

Purchase or buy Book, Sales Book, Purchases Returns Book & Sales Returns Book

Bank Reconciliation Statement

Ledger

Objectives and Preparation of Trial Balance

Depreciation

Provisions and Reserves

Promissory Note and Bills of Exchange

Accounting Treatment of Bill Transactions

Rectification of Errors

Financial Statements

Balance Sheet

Trading and Profit and Loss Account

Sole Proprietorship Trading, Profit & Loss Account and Balance Sheet

Limitations and Uses of Incomplete Records

Statement of Affairs Method for regulating Profit & Loss

Financial Statements of Not-for-Profit Organizations

Syllabus for Class 12th Accountancy

Here partnership firms and companies will come into the picture. What are the main subjects?

Accounting for partnership firms: Partnership deeds, preparation of profit and loss accounts, admission of a partner, retirement, and death of a partner, and dissolution of a partnership firm.

Accounting for the organization: Accounting for share capital and accounting for debentures will be clear here.

Analysis of financial statements: The students are taught how to analyze financial statements using various tools such as ratio analysis.

Cash flow statement

Besides the students are also given classes in computerized accounting.

Books followed in the

Accounts Coaching Classes

in Chandigarh

T.S. GREWAL

D.K. GOEL

P.C. TULISAN

S.A. SIDDIQUE

Importance of

Accounts Coaching Classes

in 12th Class?

The majority of class 12 students would answer this question by saying that it is essential to get a good score in the subject. Which is perfectly true. But by focusing on a broader aspect, you will realize the following.

Preparing for accountancy for class 12 will:

Enhance your chances of getting admissions to a good institute that broaden your exposure and knowledge

Keep your foundation strong

Broaden your skills set and competency

Gain your confidence

Train you to be able to understand advanced accounting concepts with ease method

Offer you opportunities that can make you a versatile accountant in the future

Help you get a job in some of the best financial consultant companies due to the rising demand for accountants

Help you get one step closer to writing the common proficiency test (CPT)

Help you get one step closer to becoming a Chartered Accountant (CA)

Teaching Methodology:

One to one attention (individual attention) is a great favor in Accounts Coaching Classes in Chandigarh.

All illustrations and exercises in a textbook & practice manual will be explained.

Students are given instructed to do all exercise problems and submit. Corrections will be made then and there. If required related concepts will be explained once again, where the students find it difficult to solve the exercise problems.

Mock tests will be directed for each chapter and if needed for each concept.

Questions that appeared in previous year’s question papers will also be solved or explained.

Parents are informed then and there concerning wards performance

How should you prepare for

accounts in class 12th?

Accountancy has both theoretical topics and practice-based topics in every chapter. There are six exact steps to be followed while preparing for accounts in class 12th.

Step 1: Study the theory – definitions, conceptual explanations, applications and p 4: Work on questions at the end of every chapter – at the end of the third step, you must be comparatively thorough with a chapter and its concepts. Now is the best time to work on the problems, questions, and adjustments that are available at the end of every chapter of the textbook. This will not only make you comprehensively thorough but will also demonstrate various kinds of questions that can be asked in the exam.

Step 5: Analyze past year’s papers – past year’s papers on accountancy for class 12th is available on 2 main sources, the internet, and books by many authors. Sometimes, the last few pages of your accountancy textbook could also have several year’s papers. By checking these papers, you can get a clear-cut idea and outline of:

Question paper format

Emphasized topics

Allocation of marks

Frequently asked questions

Answer expectation

Step 6: Solve sample papers – numerous students think that analyzing the past year’s papers are sufficient in conducting a good score. But sample papers are equally essential when offered by the right source. These sample papers will give you information and updates on:

Any changes in the question paper format

Any predicted questions

Changes in answer expectations

Changes in answer pattern

After following these steps, you will know that you are not only prepared with the right answers but also prepared for any changes or surprises that may happen in the examination hall. You would have learned to manage time, maintain your confidence, work efficiently, and stay aware.

Benefits of

Accounts Coaching Classes

in Chandigarh for 11th 12th Classes

Commerce students who have ambitions and aspirations for prosperous careers in the world of accounting only have one year to familiarize themselves with the basic accounting concepts; Class 11. While there are advanced concepts to learn in Class 12, candidates must grasp the basics in Class 11 to make sure that they don’t face any problems in understanding advanced concepts in the future. With an accounts home tutor, candidates can gain greater insights into accounting concepts and learn them thoroughly.

Classroom teaching at school may not always be efficient as teachers have limited time to explain concepts. However, a home tutor can take as much time as needed to explain concepts thoroughly. Regular Practice: Your accounts teacher at school may be great, but they cannot ensure that you are practicing regularly. There are two-parts of accountancy; the theoretical side and the practical side. What you learn in your accounts theory section will be of less use if you cannot use it practically. Coaching classes helps in this regard as they can assign tasks and homework for students that they need to submit regularly.

School teachers also mostly rely on the advised school textbook for examples and problems. However, a home tutor has the freedom to use any resource they see fit and may also come up with problems that students have to solve. Correspondence with Parents: School teachers remain under a lot of pressure for the whole academic session and apart from the two or three parent-teacher meetings scheduled by the school, they don’t get many chances to speak to parents. However, a home tutor can keep parents up-to-date regarding the performances of their children. Parents can use this information to motivate their children to practice more and they can also be more aware of the difficulties their children are facing with regards to accountancy.

Careers in Accounting

Finding a job in the accounting field is one of the decisions. Accounting is a field that will always be in demand and it is a field that you can continue to develop and move up inside your organization. There are various positions you can find in the accounting field. Careers in the accounting field can differ from entry-level positions to executive level. Choose the accounting career you are most interested in learning what it requires, what education you may require, and the salary you can potentially earn.

Jobs in Accounting

Accountant

Accounting Assistant

Accounting Clerk

Accounting Manager

Accounts Payable Clerk

Accounts Receivable Clerk

Bookkeeping

Budget Analyst

Certified Internal Auditor

Chief Financial Officer – CFO

Comptroller/Controller

CPA

Forensic Accounting

Government Accounting

Payroll Clerk

Staff Accountant

Tax Accountant

Why us for

Accounts Coaching Classes

in Chandigarh?

Accounts Coaching Classes in Chandigarh apply ease techniques to train our students and make smooth command over the desired subject. We have a practical approach and follow the 360-degree feedback system, to maintain hygiene in our Service Delivery Eco system. We prefer to deliver Quality students/professionals instead of delivering a lump of students reaching nowhere! Accountancy coaching classes in Chandigarh have the best and experienced teachers, offering students total insight and ample knowledge of the subject.

Exclusive Study Material

Properly compiled study material is our specialty which contains

Complete course topic-wise,

The easy language that helps in remembering the concepts,

Flow charts,

Diagrams,

Tabular representation,

Solved and unsolved questions,

Fast Track Revision section,

Important points to remember,

Do’s and Don’ts for the exam.

All these spotless features make this study material exclusive.

Routine Feedback & Tests

Surprise tests and feedback are important to make sure the student has understood the concept thoroughly. We believe in a quality product, therefore students are given regular tests and feedback on their work.

Our modernistic system will take the test of our students online and make sure that the result of the feedback is given immediately.

Doubt solving sessions

Our teaching sessions and methods are different and simple giving students no doubts about any concepts.

If there is any query or doubt, our doubt solving session or one to one sessions with students will work wonders to solve the problem of the students. Examples of the concepts should be studied to lay strong foundations for the chapter before moving next to complex adjustments.

Step 2: Solve accounting problems – after having enhanced the base knowledge for the chapter, you can go ahead with working on simple-moderate accounting problems. These accounting problems will have terms or concepts that have been explained in the theoretical expansion of the chapter.

Step 3: Practice computerized accounting – repeatedly practicing accounting on a spreadsheet or DBMS or even on software like Tally can make a huge difference in keeping what you studied and can lead to a better understanding of treating some accounting adjustments.

0 notes

Text

Latest Edition Question Bank Class 11 Economics for Annual 2024 Exam Preparation

Best CBSE Question Bank for Class 11 2024 Economics provides students with chapter wise important terminologies. Each chapter division provided herein reflects on important concepts through different typologies of questions including very short/short and long answer type. Best CBSE Question Bank for Class 11 includes practice papers based on analysis of time management skills by CBSE

0 notes

Text

CBSE to prepare question bank of previous year papers

CBSE to prepare question bank of previous year papers

Working forward on its motto ‘assessment as learning’, the Central Board of Secondary Education (CBSE) has decided to prepare a question bank for classes 9 to 11. The question bank will include previous years papers and will be available on an IT platform which will be very user-friendly. The question bank will be available not only for students but also for the teachers. To help CBSE create question bank, the board the asked its affiliate schools to submit the question papers which schools prepare for the term end exams for classes 9 to 11. “The Questions may be sent for all academic subjects (English, Hindi, Science, Social Science and Mathematics for classes IX and X and; Physics, Chemistry, Biology, Mathematics, English Core and Elective, Hindi Core and Elective, Accountancy, Business Studies, Economics, History, Political Science, Geography, Psychology, Sociology, Physical Education and Computer Science for classes XI and XII) and skill (vocational) subjects for classes IX to XII for as many past years as available with school/group of schools.” The schools are also required to submit the marking scheme along with the question papers. Apart from this, CBSE has also asked the schools to submit answer copies of the toppers which can be used by other students as exemplary answers.

Source: https://www.brainbuxa.com/education-news/cbse-to-prepare-question-bank-of-previous-year-papers-9222

0 notes

Text

CBSE to prepare question bank of previous year papers

CBSE to prepare question bank of previous year papers

Working forward on its motto ‘assessment as learning’, the Central Board of Secondary Education (CBSE) has decided to prepare a question bank for classes 9 to 11. The question bank will include previous years papers and will be available on an IT platform which will be very user-friendly. The question bank will be available not only for students but also for the teachers. To help CBSE create question bank, the board the asked its affiliate schools to submit the question papers which schools prepare for the term end exams for classes 9 to 11. "The Questions may be sent for all academic subjects (English, Hindi, Science, Social Science and Mathematics for classes IX and X and; Physics, Chemistry, Biology, Mathematics, English Core and Elective, Hindi Core and Elective, Accountancy, Business Studies, Economics, History, Political Science, Geography, Psychology, Sociology, Physical Education and Computer Science for classes XI and XII) and skill (vocational) subjects for classes IX to XII for as many past years as available with school/group of schools." The schools are also required to submit the marking scheme along with the question papers. Apart from this, CBSE has also asked the schools to submit answer copies of the toppers which can be used by other students as exemplary answers.

source https://www.brainbuxa.com/education-news/cbse-to-prepare-question-bank-of-previous-year-papers-9222

0 notes

Link

CBSE Class 10 Syllabus has been designed to help students gain a deeper understanding of the subject matter.

0 notes

Text

Class 11 Commerce Online Preparation

Commerce is an important academic stream that imparts a detailed knowledge related to economy, finance, accounting and others.

Specifically , the subjects included in this stream are Economics , Business Studies , Accountancy and English along with a choice of Maths or Informatics Practices.

A perfectly devised syllabus plays a vital role in imparting required knowledge to students so that they can go for further studies and ensure a bright future.

CBSE commerce class 11 syllabus is a competent resource for students as it is structured with all relevant topics, which provide essential knowledge to students.

Even though various institutions follow there own structure of studies and exams , but they are more or less similar to that given by CBSE.

So , to guide students on illuminated paths. And help them gain real knowledge of concepts here is the Class 11 Commerce Online Preparation by Esuccessmantra.

Class 11 Commerce Video lectures

Class 11 Commerce Online Video Lectures In Saharanpur , Dehradun , Yamunanagar.

Our video notes and in-video assessments are ideal for quick revision of topics.

Our well-written study materials will support you to score more marks in the board exams.

Commerce as a stream is a gateway that leads the students towards various professional courses after completing class 12.

Chartered Accountancy (CA), Company Secretary (CS), Cost and Management Accountant (CMA), Chartered Financial Analyst (CFA), Banking Sector, Teaching Profession, etc., are few famous carrier options for commerce professionals.

Commerce as a course of education can be interpreted as a study of business and trade pursuits such as the exchange of goods and services from the producer to the final customer.

The important subjects that are educated in the Commerce subject in class 11th, comprise Accountancy, Economics, Business Studies, Statistics, Mathematics and Informatics Practices.

There are various combinations of subjects that the students can choose in their class 11

Class 11 Commerce Pendrive Classes

The Class 11 Commerce pendrive Classes In Saharanpur , Dehradun , Yamunanagar.

Class XII CBSE Commerce USB Pendrive Course Ver 2.0 (Accounts Business studies Economics) with English (core).

All Lessons are Interactive Multimedia Video lessons with multiple Questions on the Basis of CBSE Evaluation Blue Print.

Topic WISE TEST of All — 4 Subjects. Total TOPICS available are _121 X 50 QUESTIONS

High quality content by Teachers, Resource Persons. It is easy to understand and remember, you can revise faster.

Format: Pen Drive/USB, Language: English, Valid Upto: life-time Active

Video can run on any laptop/computer also can be configure windows operating system.

Exam Attempt Year: 2020, Topics Covered: CBSE syllabus based all topics.

Demo Lecture Link

Click Here

Test Your Knowledge Through Scheduled Mock Tests

Our students also get access to schedule mock tests and practice sets.

Upon successful registration, you will get access to mock tests.

The syllabus and time table for the mock tests will be share in advance to help you prepare in time.

The mock tests are mark just like in the main examination pattern to help you track your progress.

The question paper format and pattern are similar to the main examination to give you a real feel of the exam.

Once you attempt any mock test, you have to send the scanned answer copy to our email ID.

Our experts will check the content and provide the result as well as the answer key.

You can match the answer key with your answers and analyze your weak and strong points.

We at success mantra ensures to provide the best roadmap towards their success/destination.

Success mantra is the one of the best ed-tech firm with the mission of providing best quality teaching to their students via many electronic mode as well in physical mode.

We are proud to say that we have achieved our objectives to great extent resulting in many toppers and high scorers student from SUCCESS MANTRA and best success rate among the industry.

However it is not the end but the start only towards imparting knowledge to students across the globe and helping them in achieving their targets although it depends upon the skills, ability and hard work of the students we are just guide to them.

Preparing for class 11th commerce board exams becomes easier with class 11 Commerce online preparation video lectures.

Contact our exam expert now to know more about the course, duration, and other details.

www.esuccessmantra.com

0 notes

Text

CBSE 11-12th Class Economics Syllabus

CBSE 11th Class Economics 2018-19

Class XI Part A: Introductory Microeconomics Part B: Statistics for Economics Class XII Part A: Introductory Microeconomics Part B: Introductory Macroeconomics

CBSE 12th Class Economics 2019-20

Class XI Part A: Introductory Microeconomics Part B: Statistics for Economics Class XII Part A: Introductory Macroeconomics Part B: Indian Economic Development

Part A: Introductory Microeconomics

Unit 1: Introduction --- 8 Periods Meaning of microeconomics and macroeconomics; positive and normative economics What is an economy? Central problems of an economy: what, how and for whom to produce; concepts of production possibility frontier and opportunity cost. Unit 2: Consumer's Equilibrium and Demand -- 32 Period Consumer's equilibrium - meaning of utility, marginal utility, law of diminishing marginal utility, conditions of consumer's equilibrium using marginal utility analysis. Indifference curve analysis of consumer's equilibrium-the consumer's budget (budget set and budget line), preferences of the consumer (indifference curve, indifference map) and conditions of consumer's equilibrium. Demand, market demand, determinants of demand, demand schedule, demand curve and its slope, movement along and shifts in the demand curve; price elasticity of demand - factors affecting price elasticity of demand; measurement of price elasticity of demand – percentage-change method. Unit 3: Producer Behaviour and Supply 32 Periods Meaning of Production Function – Short-Run and Long-Run Total Product, Average Product and Marginal Product. Returns to a Factor Cost: Short run costs - total cost, total fixed cost, total variable cost; Average cost; Average fixed cost, average variable cost and marginal cost-meaning and their relationships. Revenue - total, average and marginal revenue - meaning and their relationship. Producer's equilibrium-meaning and its conditions in terms of marginal revenue-marginal cost. Supply, market supply, determinants of supply, supply schedule, supply curve and its slope, movements along and shifts in supply curve, price elasticity of supply; measurement of price elasticity of supply - percentage-change method. Unit 4: Forms of Market and Price Determination under Perfect Competition with simple applications.--28 Periods Perfect competition - Features; Determination of market equilibrium and effects of shifts in demand and supply. Other Market Forms - monopoly, monopolistic competition, oligopoly - their meaning and features. Simple Applications of Demand and Supply: Price ceiling, price floor.

Part B: Statistics for Economics

In this course, the learners are expected to acquire skills in collection, organisation and presentation of quantitative and qualitative information pertaining to various simple economic aspects systematically. It also intends to provide some basic statistical tools to analyse, and interpret any economic information and draw appropriate inferences. In this process, the learners are also expected to understand the behaviour of various economic data. Unit 1: Introduction 07 Periods What is Economics? Meaning, scope, functions and importance of statistics in Economics Unit 2: Collection, Organisation and Presentation of data 27 Periods Collection of data - sources of data - primary and secondary; how basic data is collected, with concepts of Sampling; Sampling and Non-Sampling errors; methods of collecting data; some important sources of secondary data: Census of India and National Sample Survey Organisation. Organisation of Data: Meaning and types of variables; Frequency Distribution. Presentation of Data: Tabular Presentation and Diagrammatic Presentation of Data: (i) Geometric forms (bar diagrams and pie diagrams), (ii) Frequency diagrams (histogram, polygon and ogive) and (iii) Arithmetic line graphs (time series graph). Unit 3: Statistical Tools and Interpretation 66 Periods (For all the numerical problems and solutions, the appropriate economic interpretation may be attempted. This means, the students need to solve the problems and provide interpretation for the results derived.) Measures of Central Tendency- mean (simple and weighted), median and mode Measures of Dispersion - absolute dispersion (range, quartile deviation, mean deviation and standard deviation); relative dispersion (co-efficient of range, co-efficient of quartile-deviation, co-efficient of mean deviation, co-efficient of variation); Lorenz Curve: Meaning, construction and its application. Correlation – meaning and properties, scatter diagram; Measures of correlation - Karl Pearson's method (two variables ungrouped data) Spearman's rank correlation. Introduction to Index Numbers - meaning, types - wholesale price index, consumer price index and index of industrial production, uses of index numbers; Inflation and index numbers.

Part C: Developing Project in Economics 20 Periods

The students may be encouraged to develop projects, as per the suggested project guidelines. Case studies of a few organisations / outlets may also be encouraged. Under this the students will do only ONE comprehensive project using concepts from both part A and part B. Some of the examples of the projects are as follows (they are not mandatory but suggestive): (i) A report on demographic structure of your neighborhood. (ii) Changing consumer awareness amongst households. (iii) Dissemination of price information for growers and its impact on consumers. (iv) Study of a cooperative institution: milk cooperatives, marketing cooperatives, etc. (v) Case studies on public private partnership, outsourcing and outward Foreign Direct Investment. (vi) Global warming. (vii) Designing eco-friendly projects applicable in school such as paper and water recycle. The idea behind introducing this unit is to enable the students to develop the ways and means by which a project can be developed using the skills learned in the course. This includes all the steps involved in designing a project starting from choosing a title, exploring the information relating to the title, collection of primary and secondary data, analysing the data, presentation of the project and using various statistical tools and their interpretation and conclusion.

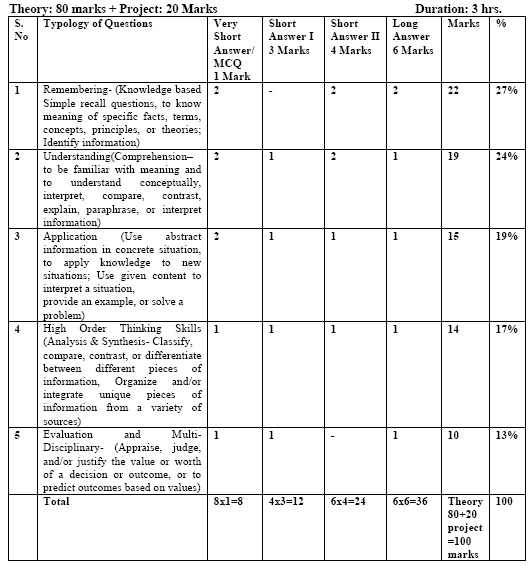

Suggested Question Paper Design

CBSE March 2019 Examination

CBSE 2018-19 Syllabus

Part A: Introductory Microeconomics

Unit 1: Introduction 8 Periods Meaning of microeconomics and macroeconomics; positive and normative economics What is an economy? Central problems of an economy: what, how and for whom to produce; concepts of production possibility frontier and opportunity cost. Unit 2: Consumer's Equilibrium and Demand 32 Periods Consumer's equilibrium - meaning of utility, marginal utility, law of diminishing marginal utility, conditions of consumer's equilibrium using marginal utility analysis. Indifference curve analysis of consumer's equilibrium-the consumer's budget (budget set and budget line), preferences of the consumer (indifference curve, indifference map) and conditions of consumer's equilibrium. Demand, market demand, determinants of demand, demand schedule, demand curve and its slope, movement along and shifts in the demand curve; price elasticity of demand - factors affecting price elasticity of demand; measurement of price elasticity of demand – percentage-change method. Unit 3: Producer Behaviour and Supply 32 Periods Meaning of Production Function – Short-Run and Long-Run Total Product, Average Product and Marginal Product. Returns to a Factor Cost: Short run costs - total cost, total fixed cost, total variable cost; Average cost; Average fixed cost, average variable cost and marginal cost-meaning and their relationships. Revenue - total, average and marginal revenue - meaning and their relationship. Producer's equilibrium-meaning and its conditions in terms of marginal revenue-marginal cost. Supply, market supply, determinants of supply, supply schedule, supply curve and its slope, movements along and shifts in supply curve, price elasticity of supply; measurement of price elasticity of supply - percentage-change method. Unit 4: Forms of Market and Price Determination under Perfect Competition with simple applications. 28 Periods Perfect competition - Features; Determination of market equilibrium and effects of shifts in demand and supply. Other Market Forms - monopoly, monopolistic competition, oligopoly - their meaning and features. Simple Applications of Demand and Supply: Price ceiling, price floor.

Part B: Introductory Macroeconomics

Unit 5: National Income and Related Aggregates 28 Periods Some basic concepts: consumption goods, capital goods, final goods, intermediate goods; stocks and flows; gross investment and depreciation. Circular flow of income (two sector model); Methods of calculating National Income - Value Added or Product method, Expenditure method, Income method. Aggregates related to National Income: Gross National Product (GNP), Net National Product (NNP), Gross and Net Domestic Product (GDP and NDP) - at market price, at factor cost; Real and Nominal GDP. GDP and Welfare Unit 6: Money and Banking 15 Periods Money - meaning and supply of money - Currency held by the public and net demand deposits held by commercial banks. Money creation by the commercial banking system. Central bank and its functions (example of the Reserve Bank of India): Bank of issue, Govt. Bank, Banker's Bank, Control of Credit through Bank Rate, CRR, SLR, Repo Rate and Reverse Repo Rate, Open Market Operations, Margin requirement. Unit 7: Determination of Income and Employment 27 Periods Aggregate demand and its components. Propensity to consume and propensity to save (average and marginal). Short-run equilibrium output; investment multiplier and its mechanism. Meaning of full employment and involuntary unemployment. Problems of excess demand and deficient demand; measures to correct them - changes in government spending, taxes and money supply. Unit 8: Government Budget and the Economy 15 Periods Government budget - meaning, objectives and components. Classification of receipts - revenue receipts and capital receipts; classification of expenditure – revenue expenditure and capital expenditure. Measures of government deficit - revenue deficit, fiscal deficit, primary deficit their meaning. Unit 9: Balance of Payments 15 Periods Balance of payments account - meaning and components; balance of payments deficit-meaning. Foreign exchange rate - meaning of fixed and flexible rates and managed floating. Determination of exchange rate in a free market.

Part C: Developing Project in Economics 20 Periods

Suggested Question Paper Design

CBSE March 2019 Examination

Note: There will be Internal Choice in questions of 3 marks, 4 marks and 6 marks in both sections (A and B). (Total 3 internal choices in section A and total 3 internal choices in section B).

Guidelines for Project Work in Economics (Class XII)

Students are supposed to pick any ONE of the two suggested projects. The project should be of 30-40 pages (approx), preferably hand-written. Teachers should help the students to select the topic after detailed discussions and deliberations. Teacher should play the role of a facilitator and should supervise and monitor the project work of the student. The teacher must periodically discuss and review the progress of the project. The teacher must play a vital role of a guide in the research work for the relevant data, material and information regarding the project work. Also, the students must be guided to quote the source (in the Bibliography/References section) of the information to ensure authenticity. The teacher must ensure that the students actually learn the concepts related to the project as he/she would be required to face questions related to the project in viva-voce stage of the final presentation of the project. Empirical study based / investing project work may be appreciated. The teacher may arrange a presentation in the classroom of each and every student so that students may learn from each others’ project work. The teacher must ensure that the students learn various aspects of the concept related to the topic of the project work. I. Project (Option One) : What’s Going Around Us The purpose of this project is to – Enable the student to understand the scope and repercussions of various Economic events and happenings taking place around the country and the world. (eg. The Dynamics of the Goods & Services Tax and likely impacts on the Indian Economy or the Economics behind the Demonetisation of 500 and 1000 Rupee Notes and the Short Run and Long Run impact on the Indian Economy or The impact of BREXIT from the European Union etc.) Provide an opportunity to the learner to develop economic reasoning and acquire analytical skills to observe and understand the economic events. Make students aware about the different economic developments taking place in the country and across the world. Develop the understanding that there can be more than one view on any economic issue and to develop the skill to argue logically with reasoning. Compare the efficacy of economic policies and their respective implementations in real world situations and analyse the impact of Economic Policies on the lives of common people. Provide an opportunity to the learner to explore various economic issues both from his/her day to day life and also issues which are of broader perspective. Scope of the project: Student may work upon the following lines: Introduction Details of the topic Pros and Cons of the economic event/happening Major criticism related to the topic (if any) Students’ own views/perception/ opinion and learning from the work Any other valid idea as per the perceived notion of the student who is actually working and presenting the Project-Work. Mode of presentation and submission of the Project: At the end of the stipulated term, each student will present the work in the Project File (with viva voce) to the external examiner. Marking Scheme: Marks are suggested to be given as –

The external examiner should value the efforts of the students on the criteria suggested CBSE Suggestive List 1. Micro and small scale industries 2. Food supply channel in India 3. Contemporary employment situation in India 4. Disinvestment policy 5. Health expenditure (of any state) 6. Goods and Services Tax Act 7. Inclusive growth strategy 8. Human Development Index 9. Self help groups 10. Any other topic II. Project (Option Two): Analyse any concept from the syllabus The purpose of this project is to – Develop interest of the students in the concepts of Economic theory and application of the concept to the real life situations. Provide opportunity to the learners to develop economic reasoning vis-a-vis to the given concept from the syllabus. Enable the students to understand abstract ideas, exercise the power of thinking and to develop his/her own perception To develop the understanding that there can be more than one view on any economic issue and to develop the skill to argue logically with reasoning Compare the efficacy of economic policies in real world situations To expose the student to the rigour of the discipline of economics in a systematic way Impact of Economic Theory/ Principles and concepts on the lives of common people Scope of the project: Following essentials are required to be fulfilled in the project. Explanation of the concept: - Meaning and Definition - Application of the concept - Diagrammatic Explanation (if any) - Numerical Explanation related to the concept etc. (if any) - Students’ own views/perception/ opinion and learning from the topic.. Mode of presentation and submission of the Project: At the end of the stipulated term, each student(s) will present their work in the Project File (with viva voce) to the external examiner. Marking Scheme: Marks are suggested to be given as –

The external examiner should value the efforts of the students on the criteria suggested. CBSE Suggested List: Price Determination Price Discrimination Opportunity Cost Production Possibility Curve Demand and its determinants Supply and its determinants Production – Returns to a Factor Cost function and Cost Curves Monopoly Oligopoly Monopolistic Competition Credit Creation Money Multiplier Central Bank and its functions Government Budget & its Components Budget deficit Exchange Rate Systems Foreign Exchange Markets Balance of payments Any other topic Contact us for tutoring and homework help Read the full article

0 notes

Text

Best Question Bank for class 11 CBSE 2024-25 |Economics Solved Practice Papers

Rachna Sagar has released Best CBSE Question Bank for Class 11 2024 Economics. Chapter-wise Important Terms given in Together with Question Bank Class 11 Economics makes understanding easier. Constructed Response Type Questions & Competency focussed questions makes learners exam ready. Solved NCERT Textbook Exercises & Practice Papers given in Solved question bank for Economics focusses on exam practice.

0 notes

Text

Best CBSE Question Bank for Class 11 2024 Economics with Topic-wise Questions

0 notes

Text

0 notes